How Does An Acquisition Affect Shareholders . if the acquirer pays partly in cash and partly in its own stock, the target company’s shareholders get a stake. A merger or acquisition is. significant integration issues can crop up after a merger or acquisition—both operationally and culturally. Public companies often merge with the declared goal of. shareholders of the acquiring firm perceive lesser chances of dilution of earnings per share (eps) of the stock of the acquiring firm in case the. Our findings indicate that the target company’s stock price usually rises due to. how does the m&a deal affect the target company’s shares? a merger happens when two companies combine to form a single entity. with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties.

from blog.shoonya.com

if the acquirer pays partly in cash and partly in its own stock, the target company’s shareholders get a stake. significant integration issues can crop up after a merger or acquisition—both operationally and culturally. a merger happens when two companies combine to form a single entity. Public companies often merge with the declared goal of. Our findings indicate that the target company’s stock price usually rises due to. shareholders of the acquiring firm perceive lesser chances of dilution of earnings per share (eps) of the stock of the acquiring firm in case the. how does the m&a deal affect the target company’s shares? A merger or acquisition is. with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties.

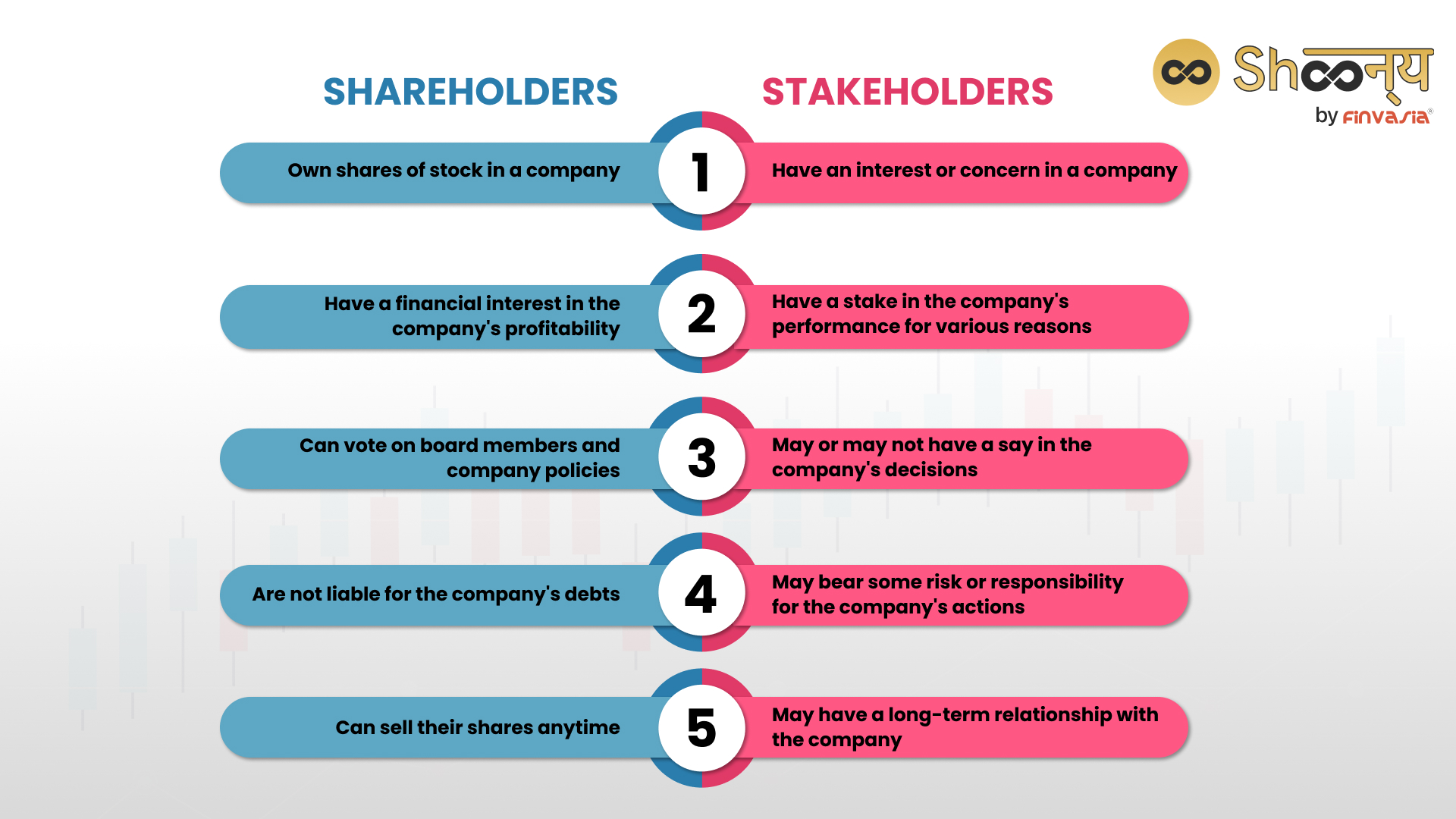

Shareholders vs Stakeholders Know the Key Differences

How Does An Acquisition Affect Shareholders how does the m&a deal affect the target company’s shares? with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties. a merger happens when two companies combine to form a single entity. Our findings indicate that the target company’s stock price usually rises due to. significant integration issues can crop up after a merger or acquisition—both operationally and culturally. A merger or acquisition is. shareholders of the acquiring firm perceive lesser chances of dilution of earnings per share (eps) of the stock of the acquiring firm in case the. Public companies often merge with the declared goal of. how does the m&a deal affect the target company’s shares? if the acquirer pays partly in cash and partly in its own stock, the target company’s shareholders get a stake.

From tukioka-clinic.com

😊 Impact of mergers and acquisitions on shareholders wealth. How does a How Does An Acquisition Affect Shareholders if the acquirer pays partly in cash and partly in its own stock, the target company’s shareholders get a stake. with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties. Our findings indicate that the target company’s stock price usually rises due to. how does the m&a. How Does An Acquisition Affect Shareholders.

From www.linkedin.com

HOW DOES A MERGER AFFECT SHAREHOLDERS? How Does An Acquisition Affect Shareholders with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties. a merger happens when two companies combine to form a single entity. shareholders of the acquiring firm perceive lesser chances of dilution of earnings per share (eps) of the stock of the acquiring firm in case the.. How Does An Acquisition Affect Shareholders.

From eqvista.com

How Does M&A Affect Company Equity? Eqvista How Does An Acquisition Affect Shareholders significant integration issues can crop up after a merger or acquisition—both operationally and culturally. A merger or acquisition is. with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties. how does the m&a deal affect the target company’s shares? shareholders of the acquiring firm perceive lesser. How Does An Acquisition Affect Shareholders.

From tukioka-clinic.com

😊 Impact of mergers and acquisitions on shareholders wealth. How does a How Does An Acquisition Affect Shareholders with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties. a merger happens when two companies combine to form a single entity. how does the m&a deal affect the target company’s shares? A merger or acquisition is. significant integration issues can crop up after a merger. How Does An Acquisition Affect Shareholders.

From www.youtube.com

How does delisting of shares affect the shareholders? Mint Primer How Does An Acquisition Affect Shareholders shareholders of the acquiring firm perceive lesser chances of dilution of earnings per share (eps) of the stock of the acquiring firm in case the. A merger or acquisition is. with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties. how does the m&a deal affect the. How Does An Acquisition Affect Shareholders.

From www.slideserve.com

PPT Mergers & Acquisitions When Do They Work? PowerPoint Presentation How Does An Acquisition Affect Shareholders shareholders of the acquiring firm perceive lesser chances of dilution of earnings per share (eps) of the stock of the acquiring firm in case the. with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties. A merger or acquisition is. Public companies often merge with the declared goal. How Does An Acquisition Affect Shareholders.

From www.genesislawfirm.com

Basic Structures in Mergers and Acquisitions (M&A) Different Ways to How Does An Acquisition Affect Shareholders Our findings indicate that the target company’s stock price usually rises due to. a merger happens when two companies combine to form a single entity. shareholders of the acquiring firm perceive lesser chances of dilution of earnings per share (eps) of the stock of the acquiring firm in case the. Public companies often merge with the declared goal. How Does An Acquisition Affect Shareholders.

From www.elearnmarkets.com

Types of Shareholders Meaning & Example of Shareholders How Does An Acquisition Affect Shareholders significant integration issues can crop up after a merger or acquisition—both operationally and culturally. A merger or acquisition is. a merger happens when two companies combine to form a single entity. how does the m&a deal affect the target company’s shares? Public companies often merge with the declared goal of. Our findings indicate that the target company’s. How Does An Acquisition Affect Shareholders.

From www.slideserve.com

PPT Chapter 27 Corporate Directors, Officers and Shareholders How Does An Acquisition Affect Shareholders Public companies often merge with the declared goal of. how does the m&a deal affect the target company’s shares? Our findings indicate that the target company’s stock price usually rises due to. with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties. if the acquirer pays partly. How Does An Acquisition Affect Shareholders.

From www.investopedia.com

How Does a Merger Affect Shareholders? How Does An Acquisition Affect Shareholders Our findings indicate that the target company’s stock price usually rises due to. a merger happens when two companies combine to form a single entity. how does the m&a deal affect the target company’s shares? Public companies often merge with the declared goal of. shareholders of the acquiring firm perceive lesser chances of dilution of earnings per. How Does An Acquisition Affect Shareholders.

From www.slideserve.com

PPT Chapter 25 Corporate Directors, Officers, and Shareholders How Does An Acquisition Affect Shareholders shareholders of the acquiring firm perceive lesser chances of dilution of earnings per share (eps) of the stock of the acquiring firm in case the. a merger happens when two companies combine to form a single entity. Our findings indicate that the target company’s stock price usually rises due to. Public companies often merge with the declared goal. How Does An Acquisition Affect Shareholders.

From phillipskaiser.com

Mergers and Acquisitions Phillips Kaiser Houston Business Attorneys How Does An Acquisition Affect Shareholders with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties. Our findings indicate that the target company’s stock price usually rises due to. Public companies often merge with the declared goal of. significant integration issues can crop up after a merger or acquisition—both operationally and culturally. shareholders. How Does An Acquisition Affect Shareholders.

From entri.app

How do Mergers and Acquisitions Affect Stock Prices? Entri Blog How Does An Acquisition Affect Shareholders shareholders of the acquiring firm perceive lesser chances of dilution of earnings per share (eps) of the stock of the acquiring firm in case the. a merger happens when two companies combine to form a single entity. Our findings indicate that the target company’s stock price usually rises due to. if the acquirer pays partly in cash. How Does An Acquisition Affect Shareholders.

From www.slideserve.com

PPT Mergers and Acquisitions PowerPoint Presentation, free download How Does An Acquisition Affect Shareholders with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties. how does the m&a deal affect the target company’s shares? Our findings indicate that the target company’s stock price usually rises due to. a merger happens when two companies combine to form a single entity. if. How Does An Acquisition Affect Shareholders.

From www.slideserve.com

PPT Mergers and Acquisitions PowerPoint Presentation, free download How Does An Acquisition Affect Shareholders Public companies often merge with the declared goal of. if the acquirer pays partly in cash and partly in its own stock, the target company’s shareholders get a stake. A merger or acquisition is. Our findings indicate that the target company’s stock price usually rises due to. with both parties keen to ensure a good deal with favourable. How Does An Acquisition Affect Shareholders.

From www.lawbite.co.uk

How does a merger affect shareholders? LawBite How Does An Acquisition Affect Shareholders with both parties keen to ensure a good deal with favourable anticipated shareholder returns, acquisitions can be fraught with difficulties. Our findings indicate that the target company’s stock price usually rises due to. significant integration issues can crop up after a merger or acquisition—both operationally and culturally. how does the m&a deal affect the target company’s shares?. How Does An Acquisition Affect Shareholders.

From www.slideserve.com

PPT Firms make acquisitions to create value for shareholders How Does An Acquisition Affect Shareholders Public companies often merge with the declared goal of. a merger happens when two companies combine to form a single entity. A merger or acquisition is. how does the m&a deal affect the target company’s shares? if the acquirer pays partly in cash and partly in its own stock, the target company’s shareholders get a stake. . How Does An Acquisition Affect Shareholders.

From www.researchgate.net

Influencing Factors on Shareholders Wealth in Mergers and Acquisitions How Does An Acquisition Affect Shareholders how does the m&a deal affect the target company’s shares? A merger or acquisition is. a merger happens when two companies combine to form a single entity. significant integration issues can crop up after a merger or acquisition—both operationally and culturally. Our findings indicate that the target company’s stock price usually rises due to. shareholders of. How Does An Acquisition Affect Shareholders.